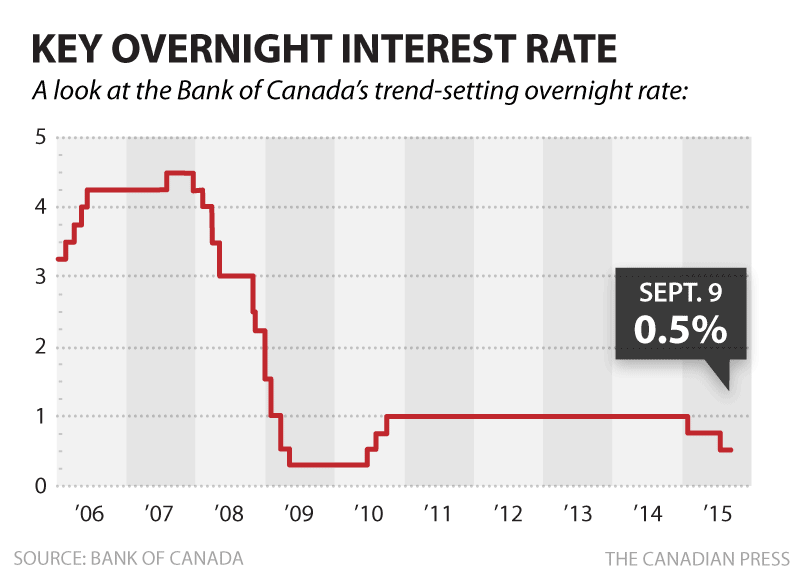

The Bank of Canada’s announcement to keep the overnight rate at 0.5% may come as no surprise to some.

In an effort to give the economy a much needed boost, BoC made two interest rate cut announcements earlier this year, 25 basis point in January and the most recent rate cut announcement by a further 25 basis points in July to 0.5% due to the falling oil prices. The aim through this initiative was to make borrowing cheaper in order to encourage more businesses to borrow.

Although the economic outcome of the previous rate cuts maybe slower than anticipated, BoC’s announcement to keep its rate at 0.5% is an indication that the past interest cuts maybe improving the economy and needs more time for results to be more eminent.

A great article published by CBC.ca gives readers information on the economic outlook.

Are you looking to buy a home, and trying to make sense of how interest rates will impact your ability to buy a home? Contact the team at MiMortgage.ca at 1 866 452-1100 to speak to an expert now.