The housing crisis in Canada has been gaining lots of media coverage over the last few years.

The introduction of Canadian Rental Housing Index in Toronto last week, in conjunction with non-profit organizations and credit unions will be helpful to track rental housing across Canada. The index will gauge overall renter income, affordability and overcrowding across the country, and will take in to account all types of rental housing available, which includes, social housing, condos, houses, self contained units in homes and purpose built rentals.

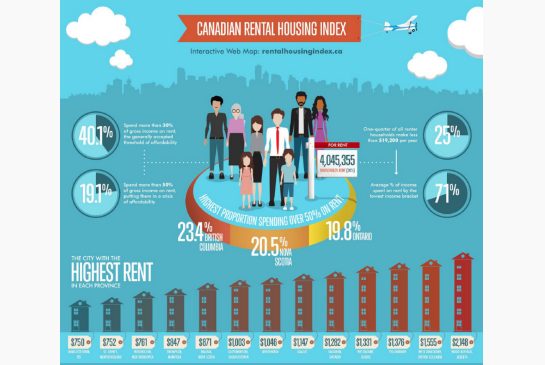

The index currently highlights that:

- Rental households constitutes for 30 per cent of households in Canada.

- 40 percent of rental households pay up to 30 percent of before-tax income on rent and utilities.

- One in five rental households pay more than half of their income on rent.

- 11 per cent of rental households live in overcrowded conditions.

While rental properties in big cities such as Toronto, Vancouver and Calgary usually are known to be higher, the affordability crisis however is more prevalent in the suburbs, where rentals have been rising consistently due to almost non-existent rental or social housing.

A great article published by The Star highlights the housing issue in Canada and the plight of renters.

While renting in any situation is not ideal, your individual circumstances may restrict you from owning your own home and instead having to rent. Contact the team at MiMortgage.ca to speak to an expert about how you can plan your finances, to enable you to buy your own home, in the future.